April 29, 2024

Financial planning is extremely valuable, both for clients and for advisors. One of the best reasons to scale your financial planning process is because people want more financial planning.

But delivering a traditional financial plan requires a customized, one-on-one process. This makes it costly for advisors and ultimately for clients.

To scale financial planning requires us to rethink existing processes and infrastructure. It requires us to reimagine how financial advice gets delivered.

In this blog post we’ll examine how you can scale up your financial planning and deliver financial plans to 100+, 500+, or even 1,000+ people per year.

Delivering 100 to 1,000+ financial plans per year is certainly possible if we can evolve the way we think about financial planning.

Why Scale Financial Planning

Clients want more financial planning and financial advice, and many are willing to pay for it. The growth in fee-only, fee-for-service, and advice-only planning shows that clients are willing to pay $2,000, $4,000, or even $6,000+ for financial planning.

There are now hundreds of fee-only and advice-only financial planners across Canada who only provide financial planning services and do not manage products or investments.

They are barely keeping up with the growing demand for financial advice. We need to do more to scale financial planning across the country.

The Financial Planning Process (Identifying Bottlenecks)

Before you can start to scale your financial planning process it’s important to understand the steps in the financial planning process itself. As you scale financial planning, pieces of the process will need to change, adapt, and evolve.

It’s important not to simply take your existing process and repeat it. Scaling financial planning requires you to revisit your process and understand where changes are required.

Typical Financial Planning Process:

- Discovery: Learn about client and gather information

- Foundation: Confirm facts and information, analyze and highlight opportunities and risks

- Planning: Develop and deliver recommendations

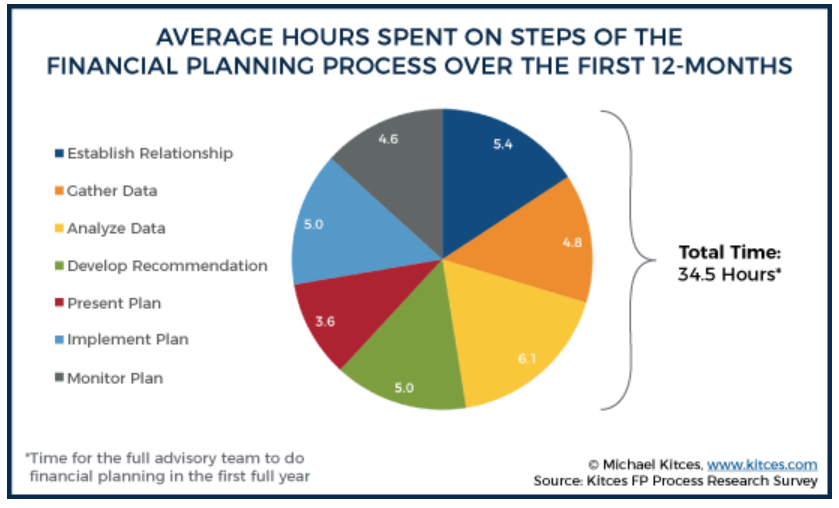

Kitces suggests that the average time spent on the financial planning process is 34.5-hours per client in the first 12-months. Some of that time is spent with the client, establishing a relationship (5.4 hours) and presenting the plan (3.6 hours), or implementing the plan (5.0 hours). This time with the client is valuable so we don’t want to start making changes there, we want to focus on other areas.

Kitces suggests that time is also spent on gathering information (4.8 hours), analyzing the data (6.1 hours), and developing the recommendations (5.0 hours). These areas represent a large opportunity for improvement. The client doesn’t necessarily care how long it takes their advisor to do these things behind the scenes, as long as the output is the same or better.

How To Do 100+ Financial Plans Per Year

To do 100+ financial plans per year means that each financial planning engagement can only take 8-10 hours for the entire engagement. This includes client meetings, data gathering, planning, and reports/recommendations.

And because the time spent with the client delivers the most value, the Discovery meeting, Foundation meeting, and Planning meeting are the most valuable parts of the process, so we need to focus on other steps to save time and increase efficiency.

There are a few important ways to scale 1:1 financial planning…

Client-led onboarding: Gathering client data can be one of the most time consuming parts of the financial planning process. A platform that allows a client to enter their own data and upload their own documents can help reduce this time significantly. It also gets the client more involved in the process itself, which increases client engagement.

All-in-one platform: After gathering client data the next step is to analyze and create recommendations. Having a single platform to seamlessly take client data and analyze/plan/summarize helps save an enormous amount of time. Having client data that automatically flows into the planning module and having a planning module that provides AI driven recommendations can save an enormous amount of time.

Self-serve client portal: One additional way to increase your efficiency is to allow clients to book meetings, manage payments on their own, and even make changes to their financial plan without the advisor. A platform that includes payment integration, calendar integration, and a full client portal, helps decrease the administrative burden of managing clients through the planning process and updating their financial plan each year.

A client-led financial planning platform like Adviice includes all of these benefits and more. With Adviice both the advisor and the client work collaboratively on a financial plan. The client can onboard themselves and even start analyzing their plan and exploring recommendations using the AI strategies. They can quickly explore things like CPP start age, OAS start age, retirement success rate, retirement spending levels, tax planning opportunities like RRSP meltdown etc. This can cut the time spent on a financial plan in half or more!

How To Do 500+ Financial Plans Per Year

To do 500+ financial plans per year means that each financial planning engagement can only take 2-3 hours for the entire engagement. This already highlights an important bottleneck, it will be impossible to have 2-3 hours of client meetings if we want to do 500+ financial plans per year.

Rather than simply streamlining the existing planning process this requires us to reimagine how financial advice can be delivered.

When delivering 500+ financial plans per year the engagement needs to include 1-hour of prep time and a 1-hour client co-planning session.

This co-planning session is like a working meeting, with the advisor going through the planning platform in real time with the client, analyzing data and answering questions.

To do this requires a few things…

- A scalable way to create client trust through video onboarding

- A platform to automatically gather client data

- A platform to do quick client-led planning

- A specific client niche to keep conversations predictable and consistent

- A clear understanding of client needs, wants, and deliverables

A client-led financial planning platform like Adviice includes all of these benefits. The external API can integrate with an email marketing platform to automatically trigger video onboarding emails when a client starts their plan. The platform also customizes itself to each client, providing them with a tailored onboarding experience.

Plus the AI Strategies allow clients to explore financial planning options in just seconds. Clients can explore options before meeting with their financial planner, this can help make the 1-hour client co-planning session more productive.

How To Do 1,000+ Financial Plans Per Year

To do 1,000+ financial plans per year means that each financial planning engagement can only take 1 hour for the entire engagement. This requires some form of group planning.

For example, if you had 10-hours to spare, and 10 clients to work with, how could you provide the most value to those 10 clients?

A traditional approach might mean you spend 1-hour with each client.

A more scalable approach might mean you put them in a group and do ten 1-hour group sessions. This provides more value as each client gets 10-hours of face time with the advisor rather than just 1-hour.

Alternatively you might put them in a group and do 1-hour of pre-recorded video onboarding, a 4-hour half day or evening session, plus a 30-minute 1:1 session with each client. This also leads to the same 10-hours in total but provides a nice mixture of self-directed, group, and 1:1 time.

To do 1,000 financial plans per year we would need to scale this approach even further, as group sessions of 10 people would still be too small.

Imagine you had a group of 40-people, perhaps from the same company, union, association etc, who all have similar pension and retirement questions. You might do a video instruction series to cover the basics before the session, then you might do a Monday morning group planning workshop with 40 people for 4-hours. And then during the rest of the week you might have 30-minute 1:1 meetings with each person. Within 1-week you’ve helped 40-people create a financial plan! You could do 25 of these group planning engagements per year and help 1,000 people create a financial plan!

Delivering 100 to 1,000+ Financial Plans Per Year

Delivering 100 to 1,000+ financial plans per year is certainly possible if we can evolve the way we think about financial planning.

Using a collaborative financial planning platform like Adviice is a critical piece of the puzzle. A collaborative platform helps guide the client through the planning process and provide a consistent experience. It helps gather and analyze information without necessarily having the advisor involved in each step of the process.

Scaling financial planning to 1,000,000 people is our mission at Adviice and we’re excited to enable financial advisors with a collaborative platform to make that possible.

If you want to deliver more financial planning to your clients then we want to work with you, reach out to us and book an intro call.

Watch a video walk-through of the Adviice Platform

Related Articles

How To Generate New Leads With Client-Led Financial Planning

Engaging new prospective clients can be challenging. Lead generation is crucial for financial advisors who want to grow their practice and help more...

How To Engage Second Generation (2nd Gen) Clients

As a financial advisor, finding new clients is vital for business growth. However, amid numerous strategies, there’s frequently one overlooked...

How to Gain New Clients With Group Information Sessions

Have you ever thought about leveraging group information sessions to grow your practice as a financial advisor? Whether it’s a casual Lunch ‘n’...

0 Comments